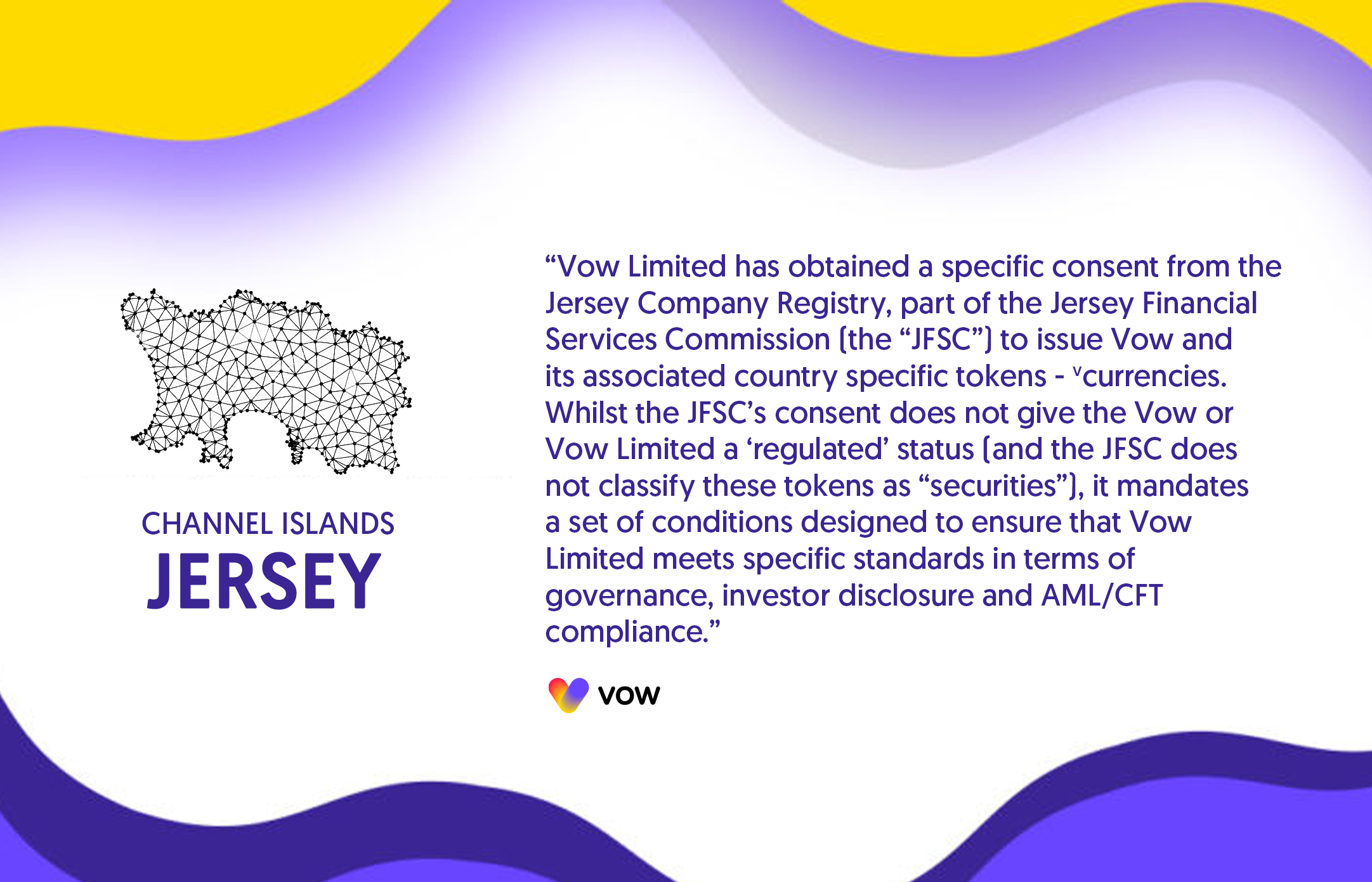

Vow is delighted to have received regulatory clarity in terms of launching from the Jersey jurisdiction.

It has taken a long time to get this certainty but it is has been well worth it.

It was very important to us that we had regulatory certainty before launching our token sale.

Perhaps it is worth understanding a bit more about the many types of cryptocurrencies available,

so that you can have some type of idea in how to how to classify them.

This Beginner’s guide to Crypto below may help give you an overview.

Types of Cryptocurrency

The Beginner’s Guide by Kraken

If you’re new to crypto, you might be wondering, how do smart people make sense of such a diverse ecosystem? With so many options, how do you tell one crypto asset from another?

Truth be told, most traders and investors have their own custom classification system.

However, there are more popular options. The most widely used method, for example, sorts crypto assets based on how they are intended to be used. This isn’t a perfect system. In fact, there remains debate about whether there are different types of cryptocurrencies at all.

For example, it’s possible all cryptocurrencies are just competing to be digital money, in which case, there might be only one type of cryptocurrency.

That said, the purpose of this article is to classify the cryptocurrencies that Kraken offers so you can get a glimpse at how these systems work and why they might be helpful when building and diversifying your crypto portfolio.

The categories below were created using methodology by Messari, a leading data and information aggregator for the crypto asset industry.

Payment Cryptocurrencies

Payment cryptocurrencies can be thought of as digital monies operated by a distributed network of computers running a shared blockchain software. Some focus on trying to compete with fiat money, while others focus on payments for a specific use case or industry.

Cryptocurrency networks aiming to disrupt payments do not typically have many features aside from those necessary to define, transfer, record and secure transactions on the network.

Some might consider Bitcoin, the original cryptocurrency, as a good example of a payment cryptocurrency, as it was designed as an alternative to traditional fiat currencies.

The majority of other payment cryptocurrencies available seek to improve upon Bitcoin in various ways, from scalability to speed.

Asset-backed cryptocurrencies can also be classified as payment cryptocurrencies.

These crypto assets are generally pegged to more traditional assets and offer the efficiency and transparency benefits of cryptocurrency while providing price exposure to more established forms of value.

Examples of payment cryptocurrencies

Bitcoin (BTC)

Bitcoin Cash (BCH)

Dai (DAI)

Dash (DASH)

Dogecoin (DOGE)

Litecoin (LTC)

Monero (XMR)

Nano (NANO)

Paxos Gold (PAXG)

Ripple (XRP)

Stellar (XLM)

Tether (USDT)

Zcash (ZEC)

Infrastructure Cryptocurrencies

Infrastructure cryptocurrencies are typically used to pay the computers responsible for running programs on a shared blockchain software network.

For example, the crypto asset that powers Ethereum is called ether, and it may be considered an infrastructure cryptocurrency, as people must purchase it in order to create and use decentralized applications running on the network.

There are many blockchain platforms that provide different use cases, and each of them requires their own infrastructure cryptocurrency.

Tokens focused on interoperability can also be categorized as infrastructure cryptocurrencies. Their goal is to provide a way to link multiple blockchains together and allow users to transact across these networks.

Examples of Infrastructure Cryptocurrencies

Algorand (ALGO)

Cardano (ADA)

Cosmos (ATOM)

EOSIO (EOS)

Ethereum (ETH)

Ethereum Classic (ETC)

Icon (ICX)

Kusama (KSM)

Lisk (LSK)

OmiseGo (OMG)

Polkadot (DOT)

Tezos (XTZ)

Tron (TRX)

Waves (WAVES)

Financial Cryptocurrencies

Financial cryptocurrencies may help users manage or exchange other crypto assets.

For example, a financial cryptocurrency might help a user trade on a decentralized exchange or make decisions about how it should be operated. Another financial cryptocurrency might be used to crowdfund money, connecting early-stage crypto projects and investors.

More complex financial cryptocurrencies may even seek to replicate financial services like market making or lending and borrowing. Further, prediction markets cryptocurrencies provide a way to speculate on the outcome of specific events.

Examples of Financial Cryptocurrencies

Augur (REP)

Balancer (BAL)

Compound (COMP)

Curve (CRV)

Gnosis (GNO)

Kava (KAVA)

Kyber Network (KNC)

Melon (MLN)

Syntetix (SNX)

Service Cryptocurrencies

Service cryptocurrencies might offer tools for managing personal or enterprise data on the blockchain. Their commonality lies in helping blockchain-based financial products access and vet external data sources.

Many service cryptocurrencies work to provide users with digital identities and link individual’s records from the real world to the blockchain.

There are many use cases for merging blockchain technology with real world applications. These can range from cryptocurrencies that provide various services for the healthcare industry (e.g., Dentacoin) to cryptocurrencies that offer file storage services (e.g., Storj, Siacoin).

Examples of Service Cryptocurrencies

Chainlink (LINK)

Filecoin (FIL)

Orchid (OXT)

Siacoin (SC)

Storj (STORJ)

Media & Entertainment Cryptocurrencies

Much like the name suggests, media and entertainment cryptocurrencies seek to reward users for content, games, gambling or social media.

For example, a media and entertainment cryptocurrency like Basic Attention Token, aims to better distribute value in an equitable way to creators and consumers.

Lastly, media and entertainment cryptocurrencies are also used to power digital worlds accessed via virtual and augmented reality technologies.